Tax advisory – what is it and why is it worth having?

2025-05-20From January 1, 2026, the depreciation limit for passenger cars will change, directly affecting the tax treatment of car-related expenses. The new regulations will primarily cover combustion vehicles and will have a significant impact on tax settlements. This is crucial information for entrepreneurs and accounting offices managing company bookkeeping.

What depreciation limits apply?

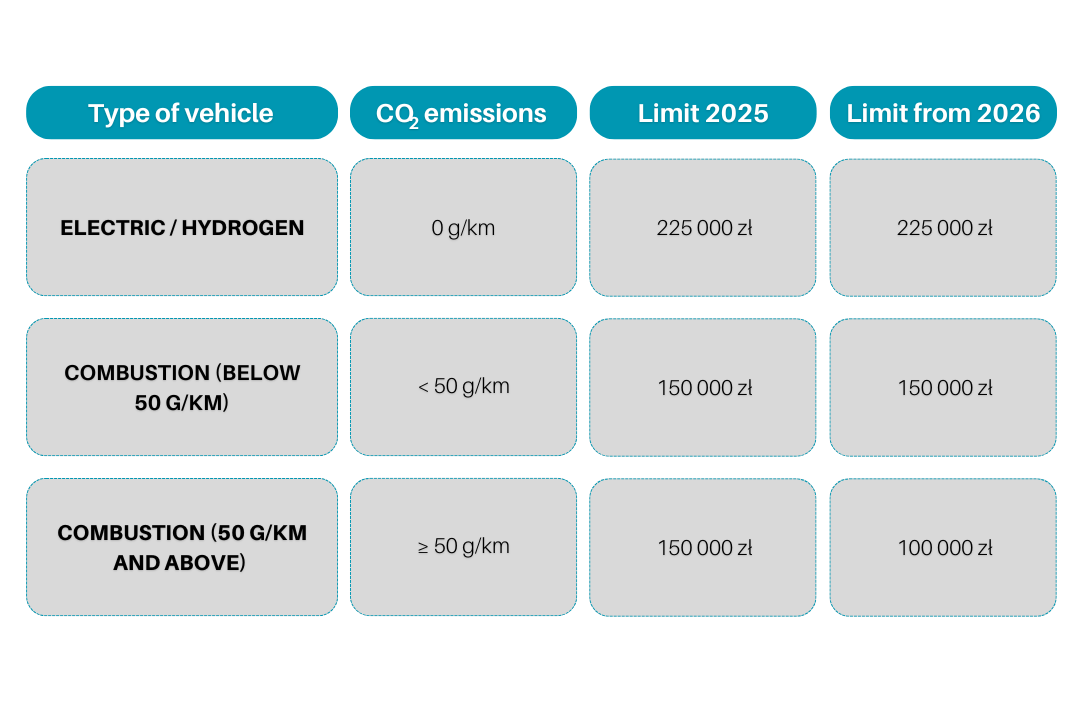

Below we present a comparison of the new and existing depreciation limits, which should be taken into account in company accounting:

The biggest change concerns combustion cars with CO₂ emissions above 50 g/km – from 2026 the depreciation limit will be reduced from PLN 150,000 to PLN 100,000. As a result, the owners of such vehicles will face higher tax costs than before.

Transitional rules and tax settlements

- Cars entered into the fixed assets register by December 31, 2025 – remain subject to the current limit of PLN 150,000.

- Vehicles entered from January 1, 2026 – will already be settled under the lower limit of PLN 100,000.

Depreciation limit for vehicles purchased on credit

In the case of a purchase financed with a loan, similar rules apply. If a company buys a car on credit and records it in the register before the end of 2025, the current rules will apply. From 2026 onwards, accounting must already take into account the new, lower values.

Leasing and rental – lack of clear rules

In the case of leasing and rental, the situation is more complex. Currently, the regulations do not provide clear transitional rules that would allow agreements concluded in 2025 to be settled under the old principles. The Polish Leasing Association is holding discussions with the Ministry of Finance, but as of today, there are no official decisions. It is worth following the announcements of the Ministry of Finance to stay up to date.

How to prepare your company for the changes?

Changes in car depreciation limits show that accounting and tax planning are the foundation of a secure business. Therefore, an entrepreneur considering the purchase, leasing, or financing of a combustion vehicle should make the decision in 2025. This way, they will retain more favorable limits and reduce additional costs.

Do you have questions about the depreciation limit and tax settlements?

Contact FPD Accounting Office – we will advise you on the best solution and take care of your accounting.